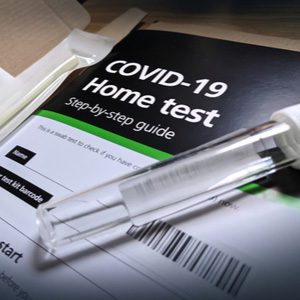

Coronavirus and Your FSA/HSA

Severe acute respiratory syndrome coronavirus 2 (SARS‑CoV‑2) is the formal name of the coronavirus responsible for the ongoing COVID-19 pandemic. In the United States, since the original outbreak we have so far experienced two variants, Delta and Omicron. Public health experts believe that, like influenza, COVID will eventually become endemic – never completely disappearing, but due to vaccination … More >>