You’re familiar with healthcare Flexible Spending Accounts (FSAs), with which you can set aside money from your paycheck pre-tax (before payroll taxes are calculated) to use in paying eligible medical expenses. You may not be as familiar, though, with the Limited-Purpose FSA (LPFSA). What is an LPFSA? An LPFSA is an option made available by some employers in conjunction with a Health Savings Account (HSA) but can be used for certain eligible expenses.

You’re familiar with healthcare Flexible Spending Accounts (FSAs), with which you can set aside money from your paycheck pre-tax (before payroll taxes are calculated) to use in paying eligible medical expenses. You may not be as familiar, though, with the Limited-Purpose FSA (LPFSA). What is an LPFSA? An LPFSA is an option made available by some employers in conjunction with a Health Savings Account (HSA) but can be used for certain eligible expenses.

Here are some questions and answers that better explain “What is an LPFSA?”

What is an LPFSA?

The LPFSA is a flexible spending account that can be used only for eligible vision and dental expenses. Unlike a regular FSA, though, an LPFSA can be held at the same time as a HSA. By not using HSA funds for dental and vision expenses, there’s more available to spend on regular medical expenses. More importantly, you may also get to keep more in your HSA as unused savings, which can help your retirement nest egg grow larger over time.

Who is Eligible for a Limited-Purpose FSA?

To have an LPFSA, you must be enrolled in an HSA. Under current IRS rules, you cannot deposit money into an HSA if you have a regular healthcare FSA; however, because LPFSAs are restricted to dental and vision care expenses, you can actively participate in both an LPFSA and an HSA at the same time. Having both accounts can help you maximize tax and savings benefits.

How Does a Limited-Purpose FSA Work?

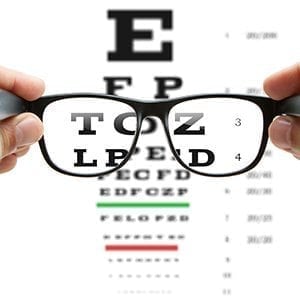

An LPFSA works just like a regular FSA. The only difference is the limitation on eligible expenses. First you designate a certain amount of money to be deducted from each paycheck and deposited into your LPFSA. You then use these pre-tax dollars to pay for eligible vision or dental expenses, such as eye exams, eyeglasses, contact lenses, dental checkups, fillings, crowns, and more. Check with your plan administrator for a full listing of eligible expenses.

As with a regular FSA, expenses incurred by your spouse and tax dependents can also be paid with LPFSA funds. In addition, depending on how your plan is structured, you may have the option of carrying over unused LPFSA funds into the next year (current maximum is $500).

Also like a regular FSA, annual contributions to an LPFSA cannot exceed $2,600. It pays to keep close tabs on your account balance at all times. Instead of denying the claim, some plan administrators will automatically reimburse an LPFSA claim out of your HSA account after LPFSA funds have been exhausted. Check with your administrator to confirm how excess LPFSA claims are handled under your plan.

No “Double-Dipping” Allowed

It’s important to remember that ‘double-dipping’ is not allowed; that is, you cannot use funds from both your LPFSA and HSA to reimburse the same eligible expense, even if the expense is considered eligible under both plans. Instead, you must decide which account will be used for each eligible expense.

Also, because LPFSA funds are pre-tax, you can’t deduct the reimbursed expenses at tax time. To avoid mistakes, keep in mind that the IRS counts eligible expenses from the day you received the service, not the day you were billed or paid for it. For example, if you have a dental cleaning on December 28, 2017, but didn’t pay for it until January 2018, the expense would count as a 2017 expense for purposes of flexible reimbursement accounts and taxes.

The LPFSA is a tax-friendly tool for paying dental and vision expenses in a manner that conserves HSA savings. If your employer offers the LPFSA, consider enrolling in it to enhance current cash flow while contributing to long-term financial security.